Research

Facts matter. And when it comes to longstanding, difficult problems like the racial wealth gap and California’s housing crisis, we cannot begin to create workable solutions without a better grasp of how we got here and the potential impacts of proposed solutions.

California Community Builders produces cutting-edge research designed to understand these problems and explore potential solutions. This research not only informs the legislation and other reforms we propose, it enables us to educate the public and policymakers, building momentum for positive change.

SEARCH RESEARCH

Single-Family Zoning’s Inherently Racist Origins Perpetuate California’s Housing Crisis Today

As a fourth-year architecture student at UC Berkeley, I’ve been exploring how building forms and layouts can influence feelings, experiences, and lives, as well as how underlying systems lead the field of architecture to be unrepresentative of the vast diversity of the country. Through this, I’ve learned about historical housing policy that has greatly affected communities of color and continues to today: single-family zoning. During my research, I’ve been disillusioned by Berkeley’s role, both the university’s and city’s, and actions that harm student and residential communities. It's hard to unlink the university from the city as they are intertwined in their roles in power and housing discrimination. Berkeley has played a major role in popularizing racial and economic segregation through zoning laws, which affects housing affordability today.

California’s Missing Middle

While California’s housing crisis gets plenty of discussion, we actually don’t know nearly enough about some of the groups most affected, particularly those defined in state law as "moderate-income." In housing policy, what we don’t know can and does hurt us.

Who is lower-middle-income California? Who is upper-middle-income in California? What are their demographics and their housing challenges? How do these compare to lower- and higher-income California? Still, what we do know is significant

Multifamily Homeownership: Pathways to Addressing the California Housing Crisis

Multifamily Homeownership (MHO) can play a vital role in solving the state's housing dilemma but is often overlooked. The report “Multifamily Homeownership: Pathways to Addressing the California Housing Crisis” provides a baseline for understanding MHO's potential, along with policies that would bring homeownership within reach for all who want it.

California’s Legislature Takes on Homeownership: An Analysis of 2022 Homeownership Bills (PART II)

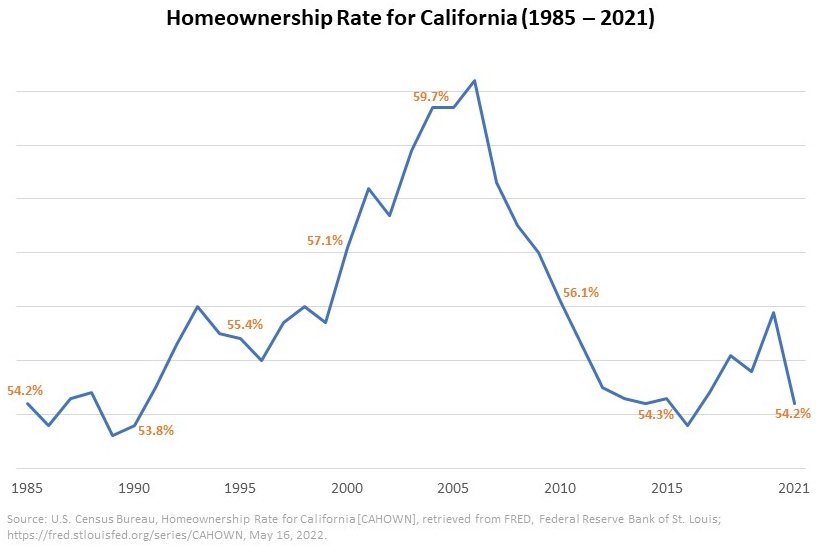

In May, we wrote about housing bills in the California Legislature that included homeownership and noted a legitimate uptick in bills which included homeownership vis-a-vis previous years. There seemed to be clear evidence that legislators weren’t just talking about homeownership and the racial wealth gap — they were writing bills to address it. So now that the dust has cleared and the 2021-22 legislative session has come to an end, did this increase in proposed bills mean that more actual bills passed?

California’s Legislature Takes on Homeownership: An Analysis of 2022 Homeownership Bills (PART I)

In order to shrink the widening racial wealth gap, California must turn around its dismal homeownership rates. In 2022, the California Legislature considered multiple bills addressing housing and homeownership – in itself notable progress compared to past years. We put together an in-depth analysis of the year’s housing legislation.

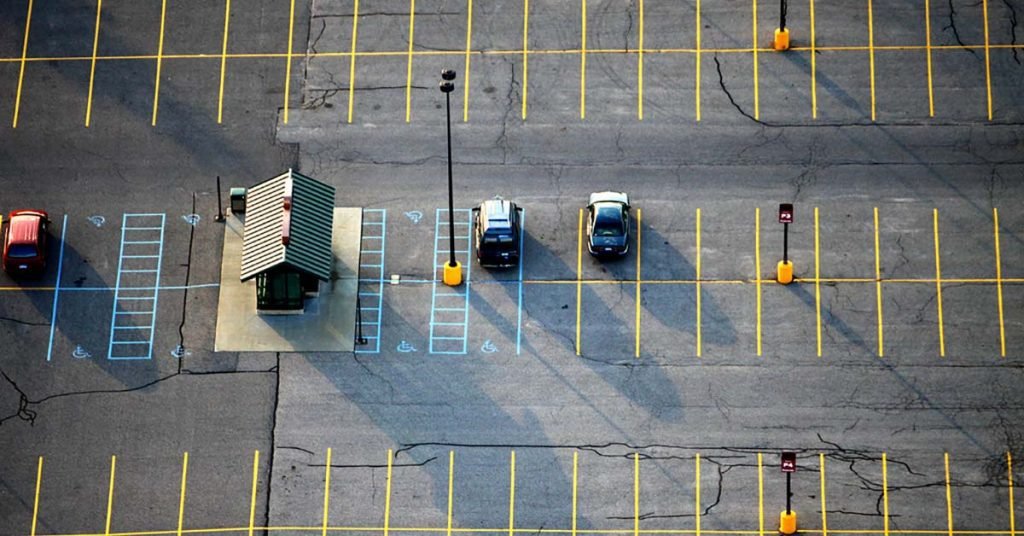

How Parking Requirements Fuel California’s Housing Crisis

Parking requirements aren’t just about cars. They’re fundamentally part of the housing equation. The list of causes of California’s deeply rooted housing crisis is long. Many of them are about housing themselves -- how we build it, finance it, regulate it. But some of them aren’t really about housing at all, but some other aspect of community building and planning: environmental concerns, fiscal issues, traffic and transportation. That includes parking requirements.

California Dream for All: A Shared Appreciation Loan Program to Support First-Time Homebuyers

In 2021 the State Treasurer’s office selected California Community Builders, as a part of a larger team led by California Forward and including HR&A Advisors and CSG Advisors, to help design the California Dream for All, a new mortgage product to support increased homeownership for underserved families that are currently shut out of the mortgage market by the high cost of down payments. The program has now been included in the 2022-23 state budget.

The Effects of Upzoning Single Family Neighborhoods on Supply and Affordability

As the housing crisis continues to grow, zoning reform has been at the forefront of policy conversations as a potential tool to combat “exclusionary zoning” -- policies used by high-income communities to stop the development of new housing in their neighborhoods. This paper attempts to model the impacts of modestly upzoning single-family neighborhoods to allow for 2-4-unit buildings in six Bay Area cities to evaluate effects on housing supply and cost.

Housing, Homeownership, and the Racial Wealth Gap: Creating Racial, Economic, and Social Equity Through Housing

Through interviewing six experts in the field of housing, and conducting a thorough literature search, we use this report to explore various topics regarding housing and homeownership, as they relate to the current racial wealth gap. Our goal is to highlight the many factors that contribute to the lack of housing asset wealth for communities of color, and to offer specific recommendations for policymakers, legislators, advocates, and other stakeholders to consider.

It’s Time to Center Women of Color in the Racial Wealth Gap Discussion

Women of color, who have been situated at the intersection of marginalized racial and gender identities, have a unique experience that is not discussed or studied nearly as much as the isolated race and gender wealth gaps. Most of the existing discussions, research, and advocacy surrounding this topic focus on the income gap. However, it is crucial to pinpoint that income and wealth are not the same. While the income gap for women is significant, it is nowhere near as large as the wealth gap. Women of color need to be included in the conversations about the racial wealth gap.

Upcoming Research

· Multifamily homeownership and its opportunities and challenges in California.

· Home lending patterns in California’s nonbank mortgage industry.